Published Date:

Mar 13, 2025

Exclusive

Mental Health

Addiction

Drugs

The Plan No One Sees Coming—But Soon Will

The Game You Didn’t Know You Were Playing

It seems to make sense now. Something big is happening. You can feel it—an invisible shift beneath the surface of the global economy. Most people haven’t noticed yet, but soon, they won’t be able to ignore it.

For decades, the United States has been losing ground in a rigged economic game. The rules weren’t written to favor American industry. Instead, they allowed foreign nations to manipulate currencies, flood markets with cheap goods, and drain U.S. manufacturing. While America focused on free trade, its rivals played by a different set of rules—one designed to weaken the U.S. from within.

But now, a new plan is emerging—one designed to flip the board, reset the game, and put America back in control. It’s a plan that few people fully understand but that everyone will soon feel. And it’s already underway.

The Economic Trap: How the U.S. Was Set Up to Lose

The decline of American industry wasn’t an accident—it was engineered. At the heart of the problem is the U.S. dollar. For years, America has played the role of the world’s reserve currency provider, meaning other countries store and trade in dollars, keeping its value high.

The result?

• American goods became too expensive abroad.

• Cheap foreign imports flooded U.S. markets, killing domestic industries.

• Jobs vanished as manufacturing moved overseas.

While China and Europe weakened their currencies to boost exports, the U.S. stood by, watching as its industries eroded. The trade deficit ballooned. The middle class suffered. And no one in power seemed to have a real solution.

Until now.

The Plan: How the U.S. Will Reengineer the Rules

This isn’t just about trade anymore—it’s about restructuring the entire global economic order.

Step 1: Weaponizing Tariffs

For years, the U.S. was told that tariffs were outdated. That was a lie. In reality, tariffs are one of the most powerful economic weapons available. By taxing foreign imports, the U.S. forces companies to either:

-

Lower their prices to stay competitive.

-

Move production back to the U.S.

But here’s the twist: tariffs alone aren’t enough. That’s why the next step is even bigger.

Step 2: Controlling the Dollar to Reverse the Trade Deficit

A strong dollar has been America’s greatest weakness. Now, it’s becoming its greatest weapon. To fix the trade imbalance, the U.S. is strategically adjusting the dollar’s value—not through direct devaluation, but through a new financial tool that other nations have used for years:

A Sovereign Wealth Fund (SWF). Think like an investor.

By accumulating foreign currencies instead of U.S. dollars, America can reduce demand for its own currency, making the dollar weaker. A weaker dollar means U.S. goods become cheaper for global buyers, boosting exports and revitalizing American manufacturing. Foreign competitors who manipulated their currencies for decades? They’ll suddenly lose their advantage.

This isn’t a theory—it’s a strategy that’s already playing out. And that’s just the beginning.

The Next Frontier: Acquiring and Developing Global Assets

Most people dismissed Trump’s Greenland purchase proposal as a joke. They were wrong. Buying Greenland wasn’t about land—it was about controlling strategic resources. That’s because Greenland has rare earth minerals that China currently dominates, it’s a geopolitical stronghold in the Arctic and with the right investment, it could become a self-sustaining U.S. economic hub—just like Alaska in 1867.

Now, take this idea further.

What if America began accumulating valuable global assets, not just through trade, but through strategic acquisitions and economic development?

Consider These Unfolding Strategies:

• The Canada Play: While never officially proposed, the idea of integrating Canada into the U.S. would instantly create the world’s largest economic powerhouse—rich in oil, water, minerals, and industry.

• The Gaza Investment: Some have suggested buying Gaza, developing it into a thriving trade hub rather than a war-torn battleground. A U.S.-backed economic zone could stabilize the region while generating billions in economic returns.

Each of these ideas follows a simple but powerful strategy: stop managing decline and start accumulating assets—like a Fortune 500 company acquiring undervalued investments. And while this happens, another force is working to eliminate America’s biggest weakness—its national debt.

Elon Musk’s Secret Weapon: The Department of Government Efficiency

What if the U.S. government ran like Tesla—efficient, data-driven, and stripped of bureaucratic waste? That’s exactly what Elon Musk’s proposed Department of Government Efficiency (DGE) is designed to do.

This isn’t some tech bro fantasy—it’s a realistic plan that would:

• Use AI to eliminate government waste, cutting unnecessary spending.

• Privatize or restructure inefficient agencies, reducing the national debt.

• Leverage automation and data analysis to optimize everything from budgets to logistics.

• Sell or develop underutilized government assets—turning debt liabilities into profitable ventures.

If paired with a sovereign wealth fund, the U.S. could pay down its debt not by cutting services—but by strategically growing national wealth.

Think about it:

· Tariffs and currency policy bring manufacturing back.

· A sovereign wealth fund accumulates strategic assets.

· Government efficiency eliminates debt and waste.

This is the playbook for a new economic superpower.

The Final Move: Reshaping the Global Order

If this strategy succeeds, the world won’t look the same in 20 years. The U.S. won’t just be the global consumer—it will be the global investor. The trade deficit will shrink, and key industries will return home. Strategic assets—land, energy, and resources—will become part of a new American economic empire. And, government inefficiency and debt will be eliminated through intelligent restructuring.

And here’s the biggest shift:

For decades, the U.S. has been playing defense in global trade. Now, it’s switching to offense.

The rules of the game are being rewritten—not by Wall Street, not by foreign powers, but by a new economic strategy that is just beginning to unfold. The question is no longer “Will this happen?” The question is: “How fast will it happen?”

Will most people won’t see it coming? Not likely. But soon, they’ll realize - the future has already begun.

We'll be watching.

Ed DeShields is Chairman of Community Assurance, a consolidated holding company with portfolio investments in healthTech, real estate, oil & gas, transportation and FinTech.

Other Blogs

The Plan No One Sees Coming—But Soon Will

Exclusive

Mental Health

Addiction

Drugs

Ant Pheromone Study May Improve Mental Health Outcomes

Exclusive

Mental Health

Addiction

Drugs

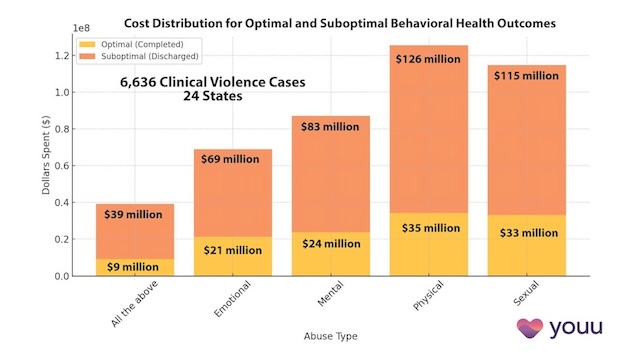

Interrupting Violence Should Be Irresistibly Investable

Exclusive

Mental Health

Addiction

Drugs

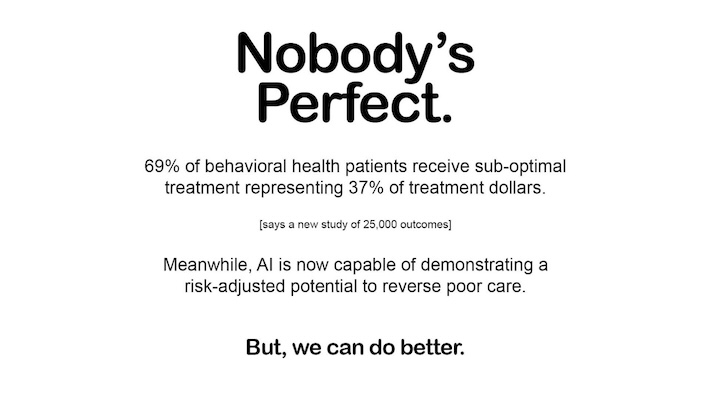

69% of Behavioral Health Patients Receive Sub-Optimal Care According to a New Analysis

Exclusive

Mental Health

Addiction

Drugs

Other Blogs

Have Questions? Lets Meet

Select a time you like to meet with us