Published Date:

Sep 28, 2023

Payers

Behavioral Health

Exclusive

Mental Health

Did Behavioral Health just reach its Sun Tzh moment?

Mental health parity has reached its Sun Tzh moment

Here's what we're watching this week on edTalk.

Mental health parity was all the talk this week in behavioral health. Parity, as promogulated and widely promoted amongst the trade rags this week, promises to muscle payers to finally pony up once-and-for-all. Or, face the consequences.

“The art of war is of vital importance to the State. It is a matter of life and death, a road either to safety or to ruin”.

Sun Tzh, The Art of War.

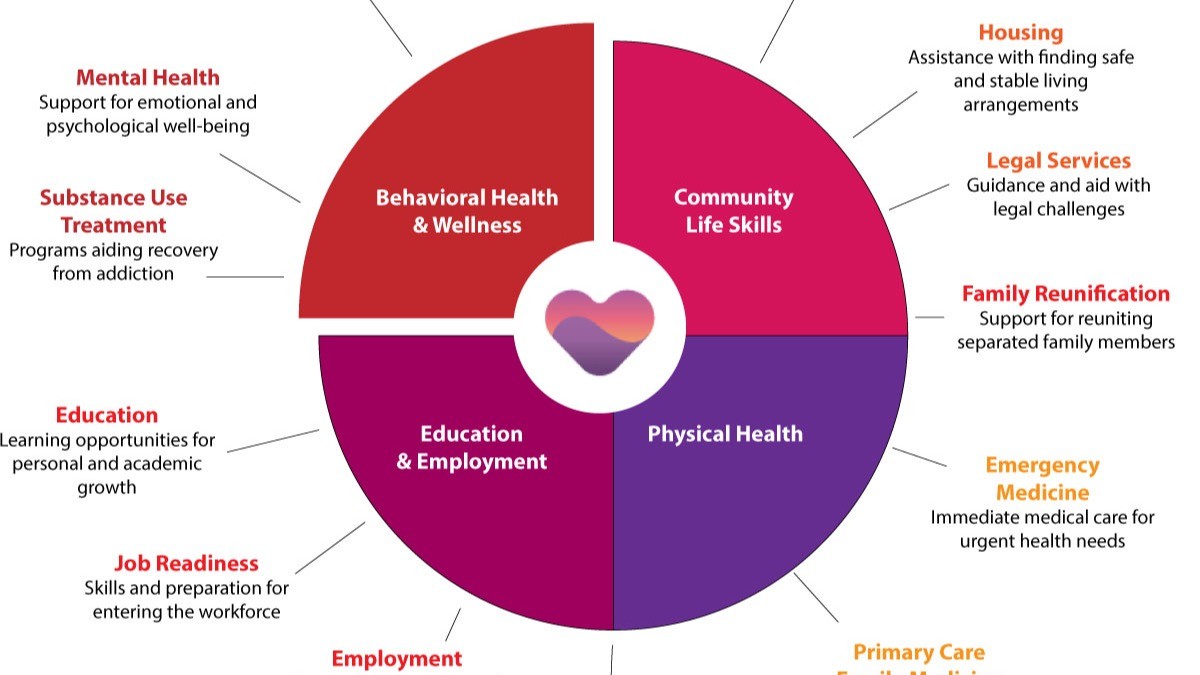

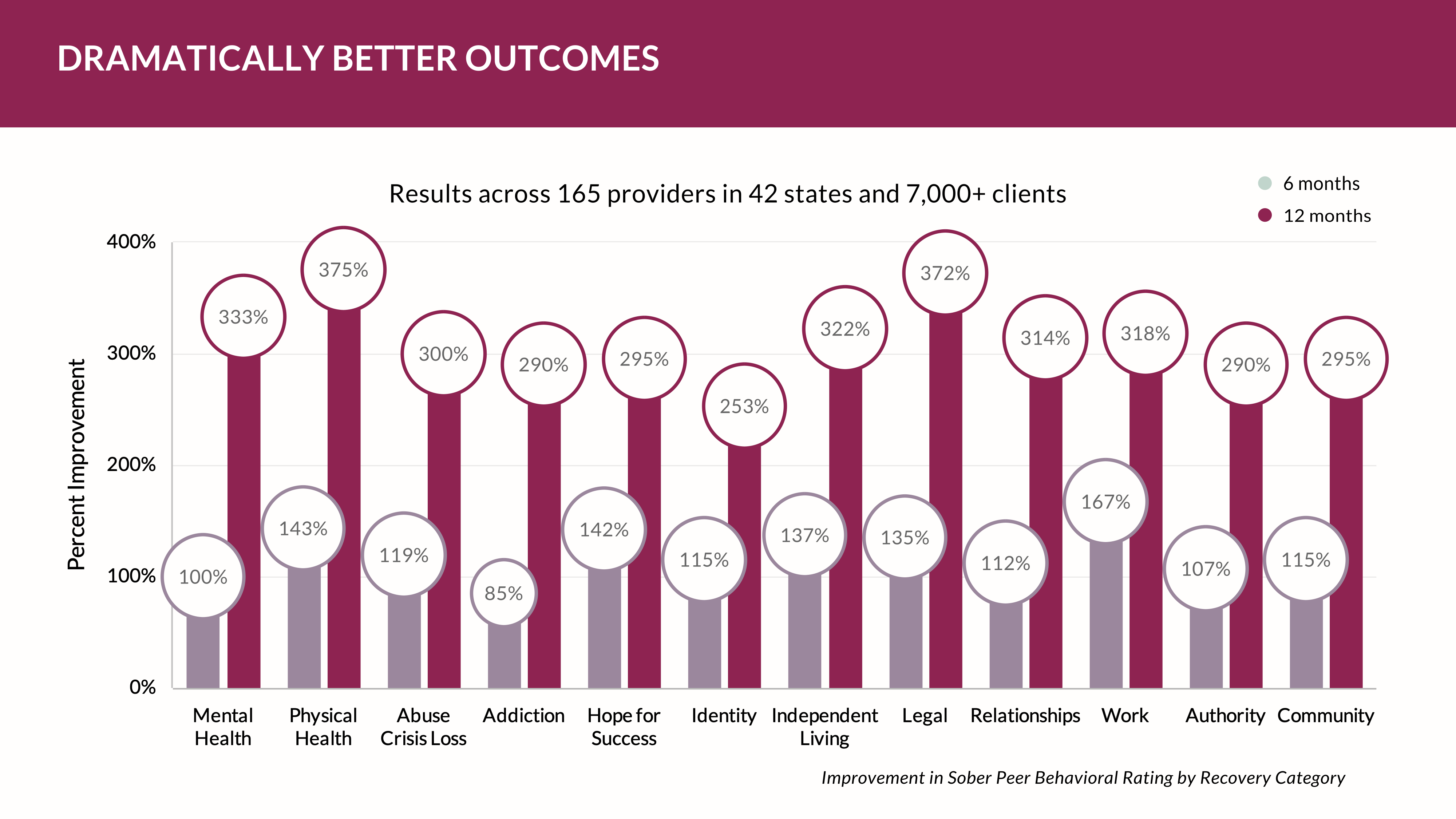

The behavioral health industry, burdened with low or no reimbursement, burned-out providers – many of whom don’t take insurance of any kind or are out-of-network or ghost providers –struggle to provide care. Nor does it often have access to the enabling health tech to track the basic outcomes or to interoperably swap health data to serve its ever-growing population.

Payers, struggling with lack of verifiable outcomes and nonquantitative standards that few can decipher, can't underwrite with certainty a member benefit. After three years of “encouragement” hardly a single payer could define its coverage standards according to the government overseers in its 2022 report to Congress.

So, after fifteen years of “guidance”, the Biden administration’s view of the MHPAEA rule is the latest sign our regulatory authorities are intending a panopticon oversight of healthcare aimed at a fundamental redesign of the health system by using brute force. It claims that making the payers cover mental health similarly to other medical qualification won’t cost the system, or the consumer, more than about 1.5% increase in our healthcare premiums. We’ll be watching.

Enlisted to serve as enforcers are the Labor department, The Employee Benefits Security Administration (EBSA), the Centers for Medicare & Medicaid Services (CMS), the Department of Health and Human Services (HHS) and the State insurance commissioners. Armed with $400 million in seed capital these bureaus will deploy hundreds of enforcement personnel to sweep the rule into place with audit authority in hopes of compelling “200 additional health plans to comply” serving “critical protection to 90,000 consumers”. That’s an interesting number.

But, there’s more. Last month, in a prequel to this week’s action, the Office of Inspector General (OIG) also issued its Information Blocking Penalties Final Rule (IBPFR) giving healthIT developers, information exchanges and data networks one million reasons to care about the recent CARES Act. This new rule authorizes the OIG to impose steep civil monetary penalties against developers and health information systems who commit information blocking between providers of up to $1 million per violation. The OIG notes that information blocking “poses a threat to patient safety and undermines efforts by providers, payers and others to make the health system more efficient and effective.”

Behavioral health, especially, will need to up-their-game because 50% of the industry doesn’t have any kind of electronic health care record system to swap anything and remain woefully unprepared for a new generation 4 healthcare infrastructure.

But, this is where it gets interesting

And, in the ultimate irony of broad blow-back in controversial enforcement rule-making, the United States Supreme Court has scheduled to hear a case against the Consumer Financial Protection Bureau (CFPB), a similar administrative authority born of the Obama administration in 2011. The case involves the constitutionality of an agency’s authority to relentlessly levy, fine or penalize an industry. In this case, the authorities levied a whopping $17.5 billion in the name of restitution and for lack of access for consumers of the banking system’s providers and insurers.

In parallel, Dodd-Frank’s banking regulation (like the CARES Act authority of today) gave an agency the absolute authority to determine whether, or not, any given consumer product or service was unfair, deceptive or abusive and therefore unlawful with arbitrary rules – and the ability to solely enforce it without an independent defense. The Supreme Court will now decide whether that authority was, in fact, constitutional. We’ll be watching the similarities of this case to this week’s rulings for healthcare.

We’ve reached our Sun Tzh moment

Sun Tzh, the ancient Chinese warrior to which the Art of War is attributed teaches us iconic lessons in offensive and defensive strategy that can be used in business.

“If the terrain is unclear, victory is unclear”

Sun Tzu’s Act War Chapter 10

We need a clear terrain for a now-certain move to value based care

Healthcare network adequacy regulations are moving us away us from fee-for-service towards the adoption of value-based reimbursement so that patients have access to a broad network of providers. The current enforcement directives require health insurance plans to maintain a parity network of providers that makes for reasonable access with geographic accessibility by adjusting the number of participating providers and specialists to a population. Providers are going to feel this pressure to participate. The most competitive among providers will have incentives to deliver more cost-effective and value-based care and prosper.

The rule’s network adequacy regulations will facilitate a swift transition to value-based reimbursement if the market terrain can be made clear. Those providers with this vision will excel.

Here’s how:

1. We must encourage more provider participation to come into the system so that patients have a choice of providers. Providers must align with payment models that prioritize value and quality over quantity, so they are attractive to a health plan's network. Payers will look to this as high-valve opportunity.

2. We must promote broad care coordination. Value-based reimbursement models demand coordinated care and the interoperable integration of services across providers. Network adequacy regulations will require health plans to include primary care providers and specialists to collaborate and coordinate patient care.

3. We must facilitate data sharing and interoperability. Value-based reimbursement models demand the exchange of health information between providers and systems. Network adequacy regulations will require health plans to have systems in place that facilitate data sharing and interoperability among their network providers. They can’t keep healthcare affordable without it.

4. We must support patient engagement and choice. Adequate networks give patients a broad range of choices when selecting health services. Patients must be able to make informed decisions about their care and seek out providers who deliver value-based and cost-effective services.

In summary, healthcare network adequacy regulations play a crucial role in promoting the shift away from fee-for-service towards value-based reimbursement. By ensuring that patients have access to a sufficient network of healthcare providers, these regulations can incentivize providers to adopt value-based care models and improve overall healthcare quality and affordability.

There’s big change ahead for behavioral health and it’s certain we’ve now entered a Sun Tzh moment.

We’ll be watching.

In the meantime we'll be listening and talking edTalk. See you next time.

Be sure to subscribe.

Other Blogs

The Plan No One Sees Coming—But Soon Will

Exclusive

Mental Health

Addiction

Drugs

Ant Pheromone Study May Improve Mental Health Outcomes

Exclusive

Mental Health

Addiction

Drugs

Interrupting Violence Should Be Irresistibly Investable

Exclusive

Mental Health

Addiction

Drugs

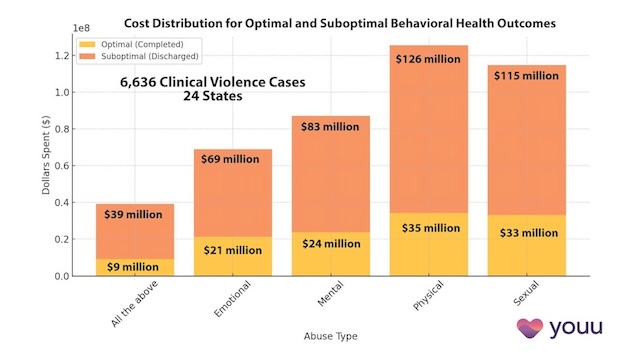

69% of Behavioral Health Patients Receive Sub-Optimal Care According to a New Analysis

Exclusive

Mental Health

Addiction

Drugs

Other Blogs

Have Questions? Lets Meet

Select a time you like to meet with us