Published Date:

Dec 10, 2024

Exclusive

Mental Health

Addiction

Drugs

Are Trump and Elon breaking up with the Federal Income Tax?

Here’s what I’m watching today.

According to economist and prognosticator Peter St. Onge, a massive Trump administration tax policy overhaul might be in the works; abolishing the Federal income tax. Sounds bold right? Indeed it does, but the details deserve serious thought.

The idea of abolishing the federal income tax and replacing it with tariffs has the potential to reshape the U.S. economy. Really, say proponents.

Proposed as part of the Trump administration’s vision, this approach seeks to reduce Americans’ tax burden while spurring economic growth. By eliminating income taxes—which currently cost Americans about $2.4 trillion annually—and implementing a 20% tariff on imports, the plan estimates it could generate about $900 billion in revenue. Imports from China would face a heightened 60% tariff, given the U.S. imports around $500 billion from China and $3.5 trillion from other countries.

The idea that tariffs make consumers pay more is naive. There's proof. We once had an America with no income tax that thrived.

Supporters of this approach believe it would act like “rocket fuel” for economic growth, potentially increasing GDP by approximately $4.5 trillion, or close to 20%.

By freeing Americans from income tax, the typical family could gain around $30,000 in additional annual income.

This potential for growth draws from economic research by Christina and David Romer, which suggests that every dollar cut in taxes could yield an increase of two to three dollars in GDP. Given that the income tax is often considered more damaging to economic growth than other types of taxes, eliminating it could create powerful incentives for work, investment, and business expansion.

Moreover, such a policy could turn the U.S. into a prime destination for businesses worldwide, as companies would be attracted to a tax environment that allows them to reinvest profits and expand more freely. Advocates anticipate that this influx of business would create jobs, drive wage increases, and support sustained growth, potentially leading to a new era where 5% GDP growth is a baseline—reminiscent of past periods in American economic history.

On the federal budget side, replacing $2.4 trillion in income tax with $900 billion in tariffs would require adjustments. Increased economic activity could bring in an additional $500 billion in payroll and excise taxes, but there would still be a gap to cover. Some suggest that reducing federal spending by $1 trillion could address this. For instance, scaling back military expenditures—estimated to save around $800 billion by focusing on defense rather than international commitments—could contribute significantly.

Reforming areas such as healthcare and welfare, modeled after efficient systems in other countries, could also yield substantial savings.

By eliminating income taxes, the proposal envisions not only a major boost to the economy but also a streamlined federal budget that aligns with lower taxation. With no IRS, a simplified tax structure, and increased disposable income, will this approach offer a vision of robust economic growth, enhanced family incomes, and permit a leaner government structure?

We’ll be watching.

Ed DeShields is Chairman of Community Assurance, a diversified holding company with a long-term investment horizon. We support strategic equity investments that support better communities.

Be sure to subscribe to edTalk for what we're following.

Other Blogs

The Plan No One Sees Coming—But Soon Will

Exclusive

Mental Health

Addiction

Drugs

Ant Pheromone Study May Improve Mental Health Outcomes

Exclusive

Mental Health

Addiction

Drugs

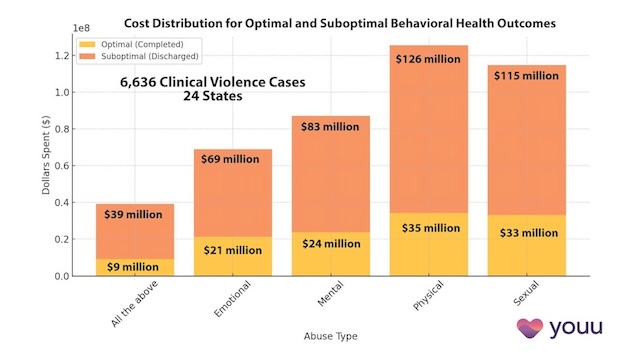

Interrupting Violence Should Be Irresistibly Investable

Exclusive

Mental Health

Addiction

Drugs

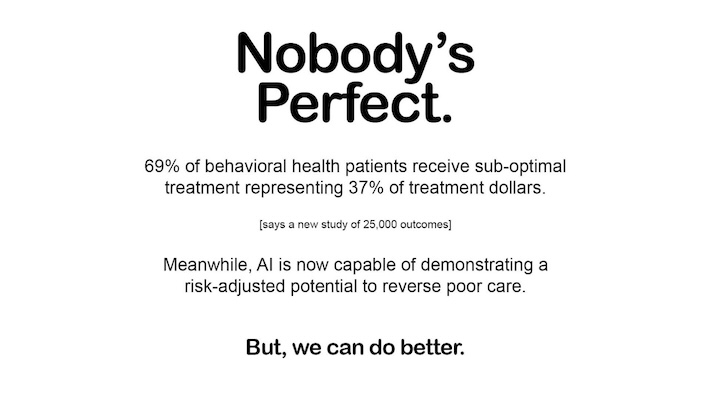

69% of Behavioral Health Patients Receive Sub-Optimal Care According to a New Analysis

Exclusive

Mental Health

Addiction

Drugs

Other Blogs

Have Questions? Lets Meet

Select a time you like to meet with us